We believe our people are our strongest asset and biggest difference

Top Creative highly qualified team use their expertise, along with our bespoke technology tools, craft and deliver the very best investment and logistics service to individuals and families, and businesses of all sizes.

Top Creative strongly believes that good corporate governance provides a sound foundation in running a responsible and sustainable organization.

The Group organizational structure is guided by customer needs and marketing functions, integrating various business and operating procedures, strengthening risk control, improving financial management, and implementing integrated cross-marketing functions to ensure that the entire organization management and business model are in line with international best practices. It is customary to provide customers with satisfactory financial services with a new management style and to improve business performance.

Conduct quality control, and good faith is the most important

We have a client-oriented culture focused on delivering value-creating solutions with transparency, integrity, professionalism, discipline, vigour, innovation and progressiveness.

As the laws and regulations are becoming updated and complete, for example, the Personal Data (Privacy) Ordinance is becoming more and more precise;

it definitely set a challenge to the financial industry.

We are committed to a high level of integrity, business excellence, world-class execution and corporate governance.

Top Creative has input much resource in quality control. We are very cautious in talents recruiting and training, we particularly focus on the good faith of our staff, business licenses and internal monitoring and so on, we do this to take up the responsibility for the public.

It is this culture that Top Creative reinforces ethical business standards in conducting all business activities with honesty, integrity and fairness.

Meet the people committed to bringing to you fresh customer experiences.

Complaint Management

The consistently high quality and rapid processing of complaints is of crucial importance to create a positive customer experience and thus emsure lasting customer loyalty.

We have a clearly defined set of core values in place to outline our expectations on staff conduct when dealing with clients and other stakeholders, including shareholders, regulators, and the communities where we operate. Those values should be reflected in the fair, prompt, and impartial handling of complaints, which includes a complaint handling policy framework to facilitate a consistent approach to complaint management, as well as oversight that satisfies regulatory requirements.

In order to support strong client relationships and client retention. Top Creative is committed to full compliance with complaint handling policy, relevant laws, regulations, guidelines and codes on all aspects of our business:

- Client satisfaction enhancement

- Reduction of mistakes and attributable costs

- Risk transparency enhancement

- Management information for quality optimization

The guidance around complaint management applies to all employees. The ability to handle formal complaints professionally and transparently is an extremely important factor influencing client satisfaction. We aim to anticipate and avoid potential complaints before they arise. To this end, we pass on process faults to responsible areas for the purpose of achieving quality improvements for our customers.

In addition, our Head of Complaint Management personally contacts selected clients who have given serious complaints. This direct dialogue helps us to better understand the reasons for complaints and provides insight into how we are perceived by our clients.

Risk & Regulatory Management

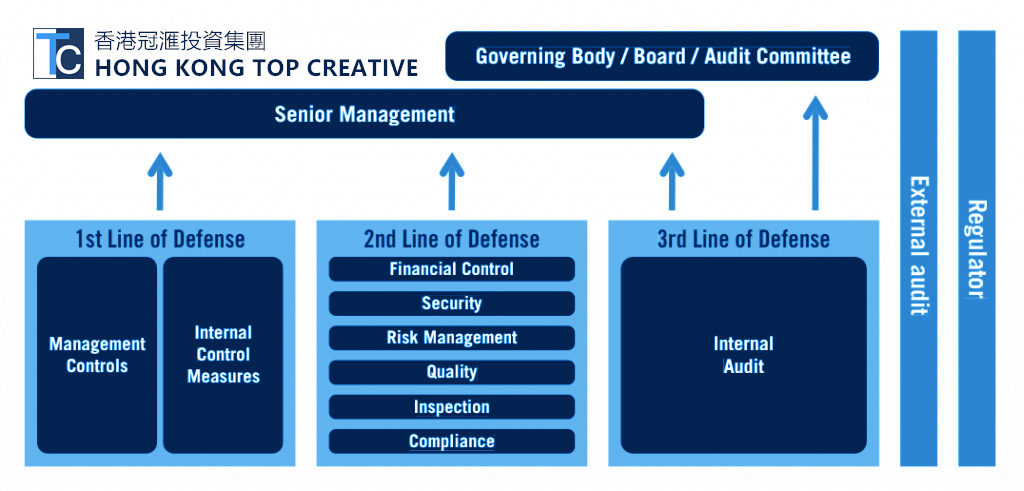

Our Board is committed to high standards of risk and regulatory management. We operate a ‘three lines of defence’ model ensuring that we are able to monitor and proactively manage risk; allowing us to respond swiftly to any identified issues

The Risk team operate within a defined Risk Management Framework, approved by the Board, and are responsible for developing risk awareness, managing and reporting on risks and providing guidance on appropriate risk management strategies.

The risk governance structure includes a monthly Management Risk Committee which provides the day to day governance of risk.

Appropriate records of risk management activities are retained in the form of Management Risk Committee minutes,supporting documentation and include data recorded on Target’s Risk Management system.

Compliance Management

Our Compliance function is divided into three key areas:

The Advisory Team provides advice & guidance to the business via service desk requests and project support to ensure all staff are conducting business in a way that is compliant and that ensures fair outcomes for consumers. The team review and approve operational policy & procedure, letter suites, training material and system changes/testing to ensure regulatory compliance.

The Regulatory Development Team continually monitors developments within the industry and produce compliance bulletins and regulatory alerts to assess impact to clients and address any regulatory/industry change.

The Financial Crime Team provides oversight & support relating to financial crime matters to the operation. Responsible for dealing with all aspects concerning financial crime including money-laundering & terrorist finance prevention, sanction checking, anti-corruption policy and fraud management issues.

Monitoring and Audit Functions

The Risk & Compliance monitoring plan is set on an annual basis with a degree of flexibility built in to accommodate any emerging issues.

We utilise a number of monitoring techniques in our approach to compliance monitoring, including regular monitoring, thematic reviews and ad hoc monitoring checks.

Internal Audit follows a risk based annual audit programme approved by the Board. This ensures appropriate coverage of operational and support areas including a focus on information security and regulatory adherence. Internal Audit management of the closure of audit findings and significant matters are escalated to the Risk & Audit committee as appropriate.